If you're in the market for a new home, you'll be pleased to hear that the Federal Housing Administration (FHA) has recently announced a reduction in annual mortgage insurance premiums (MIP) for new FHA-insured mortgage borrowers. Starting March 20th, 2023, this change will make FHA mortgages more accessible and affordable for low- and middle-income borrowers.

What is MIP?

MIP stands for mortgage insurance premium, and it is a fee that homeowners with FHA-insured mortgages pay each month to insure their mortgages. MIP is required for all FHA loans and is paid on top of the borrower's monthly principal and interest payments. The purpose of MIP is to protect lenders in case the borrower defaults on their loan. When you take out an FHA-insured mortgage, the FHA provides mortgage insurance to the lender to cover any losses they may incur if you default on your loan. MIP helps to ensure that lenders are protected and can continue to provide FHA loans to borrowers who may not qualify for a conventional loan.

The amount of MIP you pay each month is based on the amount of your mortgage, your loan-to-value (LTV) ratio, and the term of your loan. Before the recent MIP cut, the annual MIP rate for most FHA-insured mortgages was 0.85% of the loan amount. However, beginning March 20th, 2023, this rate will be reduced by 0.30 percentage points, making FHA mortgages more affordable and accessible to low- and middle-income borrowers.

What Does This Mean for Me?

If you're in the market for a new home, the recent MIP cut announced by the Federal Housing Administration (FHA) could mean significant savings for you. This reduction in MIP can save homeowners hundreds of dollars each month on their mortgage payments, making homeownership more affordable and accessible to a broader range of people.

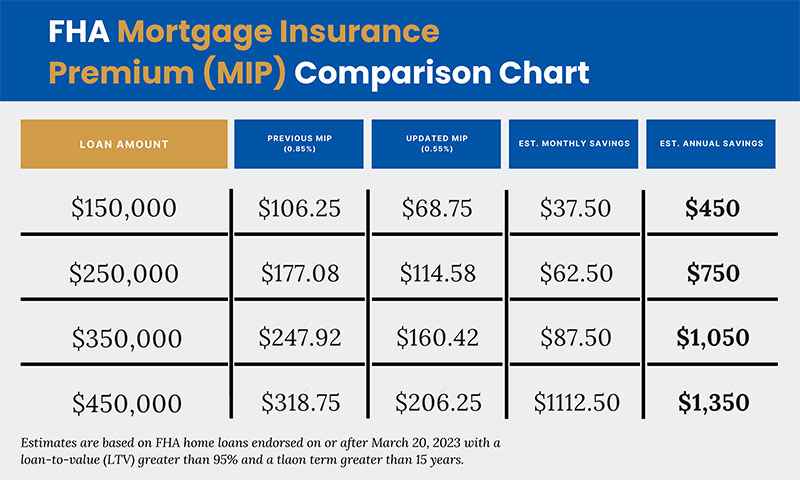

To give you an idea of potential savings, take a look at this chart based on an FHA home loan with a loan-to-value (LTV) greater than 95% and a term greater than 15 years:

This reduction in MIP will lower housing costs for an estimated 850,000 homebuyers and homeowners in 2023. And, if you're a first-time homebuyer, the news is even more exciting. Over 80% of FHA borrowers are first-time homebuyers, and over 25% are homebuyers of color. Using an FHA mortgage can help a broader range of clients in your market achieve their homeownership goals.

By taking advantage of the recent MIP cut, you can potentially save hundreds or even thousands of dollars each year on your mortgage payments, making homeownership more affordable and accessible to you.

Why would someone want an FHA-insured loan?

FHA mortgages are a type of government-backed loan that can be a valuable option for homebuyers who may need help to achieve homeownership through conventional loans. The FHA program was established to make homeownership more accessible to low- and middle-income Americans by providing lenders with mortgage insurance to protect them if the borrower defaults on their loan.

One significant advantage of FHA mortgages is their lower credit score requirements. While conventional loans typically require a credit score of 620 or higher, FHA loans can be obtained with a credit score as low as 500. However, if your credit score is below 580, you may need to make a larger down payment.

FHA loans also offer a lower down payment option, which can be as low as 3.5% of the purchase price. This can be particularly helpful for first-time homebuyers with a small amount of money saved for a down payment.

Another benefit of FHA loans is their more flexible debt-to-income (DTI) ratio requirements. Your DTI ratio is the percentage of your monthly income that goes toward paying your debts. While conventional loans typically require a DTI ratio of 43% or less, FHA loans can be obtained with a DTI ratio of up to 50%.

Finally, as we've mentioned, the recent MIP cut makes FHA loans even more attractive to borrowers who may not qualify for a conventional loan. This reduction in MIP can save borrowers hundreds of dollars each month on their mortgage payments, making homeownership more affordable and accessible to a broader range of people.

How to Take Advantage

If you're interested in taking advantage of the recent MIP cut for FHA-insured mortgages, you should contact a lender who can give you more information on your options. As a leading provider of FHA-insured mortgages, Diamond Residential Mortgage Corporation can help you explore your options and estimate your potential savings based on the new MIP cut. Our team of experienced mortgage professionals can also help you determine if an FHA-insured mortgage is suitable for your financial situation and homeownership goals.

If you're a first-time homebuyer or looking to purchase a home with a limited budget, the new MIP cut could be the perfect opportunity to make your dreams of homeownership a reality. With lower credit scores and down payment requirements, more flexible DTI ratio requirements, and now a reduction in MIP, FHA loans can help more people achieve their homeownership goals.

At Diamond Residential Mortgage Corporation, we're committed to helping our clients achieve their homeownership goals. Our team of experts can provide you with the information and guidance you need to make an informed decision about your mortgage options. We'll work with you every step of the way to ensure that your home-buying journey is as smooth and stress-free as possible.

Please don't hesitate to contact us to learn more about your options and how we can help you take advantage of the recent MIP cut. We're here to help you achieve your dreams of homeownership.